Welcome to remaining mortgage payoff calculator . When you take out a mortgage, it feels like the journey to pay it off is going to last forever. Every month you send in your payment, but sometimes you wonder: How much do I still owe? When will my loan finally be paid off? How much interest am I going to pay in the remaining years?

That’s exactly where a Remaining Mortgage Payoff Calculator comes in handy.

This free online tool helps you calculate your remaining loan balance, estimate your payoff date, and even see how much interest you could save by making extra payments. For homeowners in the United States, where average mortgage terms are 15–30 years, such a calculator is not just useful—it’s essential.

In this guide, I’ll walk you through everything you need to know about the Remaining Mortgage Payoff Calculator: how it works, why you need it, examples, strategies to pay off early, and frequently asked questions.

Table of Contents

What is a Remaining Mortgage Payoff Calculator?

A Remaining Mortgage Payoff Calculator is an online financial tool that allows you to determine:

- The current remaining balance on your mortgage.

- The time left until your mortgage is fully paid.

- The total interest you’ll pay over the remaining term.

- The effect of extra payments (monthly, yearly, or one-time).

Unlike a standard mortgage calculator that focuses on the beginning of the loan (loan amount, interest, and term), a remaining payoff calculator focuses on the present. It takes into account your existing balance and calculates how long until you are debt-free.

Why Do You Need a Remaining Mortgage Payoff Calculator?

Most homeowners only look at their mortgage statement and see the balance. But that doesn’t give you the full picture. Here’s why this calculator is so valuable:

- Clarity on Remaining Balance

- Easily check how much principal is left.

- Know Your Payoff Date

- See the exact month and year when your loan will be paid off.

- Plan Early Payoff

- Adding just $100 per month can save you thousands in interest.

- Compare Scenarios

- Decide between refinancing, extra payments, or lump-sum payoff.

- Financial Peace of Mind

- Knowing your financial future helps you plan better for retirement, investments, or even vacations.

How Does a Remaining Mortgage Payoff Calculator Work?

A Remaining Mortgage Payoff Calculator works on three main inputs:

- Current Loan Balance – the amount you still owe.

- Interest Rate – your current mortgage interest rate.

- Monthly Payment Amount – your fixed monthly installment.

Optional inputs include:

- Extra monthly payments

- One-time lump-sum payment

- Remaining loan term

The calculator then uses an amortization formula to determine:

- Time to payoff

- Interest saved with extra payments

- Adjusted payoff date

Example: How Much Can You Save?

Let’s imagine:

- Remaining loan balance: $200,000

- Interest rate: 5%

- Monthly payment: $1,073

- Remaining term: 25 years

If you stick to your current payments, you’ll pay $164,000 in interest over 25 years.

But if you add $200 extra per month, you’ll pay off the loan 7 years earlier and save $60,000 in interest.

That’s the power of the Remaining Mortgage Payoff Calculator.

Difference Between Mortgage Calculator vs Remaining Mortgage Payoff Calculator

| Feature | Mortgage Calculator | Remaining Mortgage Payoff Calculator |

|---|---|---|

| Input | Original loan amount, rate, term | Remaining balance, monthly payment |

| Focus | Start of loan | Current stage of loan |

| Output | Monthly payment estimate | Payoff date, remaining interest, savings |

| Best for | New borrowers | Existing homeowners |

Strategies to Pay Off Your Mortgage Faster

Using the calculator is the first step. The second step is taking action. Here are proven strategies:

1. Make Bi-Weekly Payments

Instead of 12 monthly payments, you make 26 half-payments. This results in 13 full payments per year, shaving years off your loan.

2. Round Up Payments

If your monthly payment is $1,073, round it to $1,100. That extra $27 each month makes a big difference over time.

3. Apply Windfalls

Got a bonus, tax refund, or inheritance? Apply it directly to your principal.

4. Refinance to a Shorter Term

Switching from 30 years to 15 years can save you thousands in interest.

5. Use the Remaining Mortgage Payoff Calculator Regularly

Track progress and stay motivated by watching your payoff date move closer.

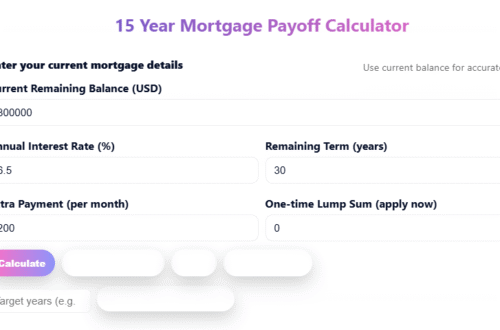

Step-by-Step: How to Use the Remaining Mortgage Payoff Calculator

- Enter your current remaining balance.

- Enter your interest rate.

- Add your monthly payment.

- (Optional) Enter extra payments.

- Click Calculate.

- Instantly see your remaining payoff date, total interest, and savings.

FAQs About Remaining Mortgage Payoff Calculator

Q1: What is the difference between a mortgage payoff calculator and a remaining mortgage payoff calculator?

A: The standard version helps new borrowers estimate payments, while the remaining version helps existing homeowners calculate their remaining balance and payoff time.

Q2: Can I calculate how much interest I’ll save with extra payments?

A: Yes, the calculator shows how much you’ll save if you make extra monthly, yearly, or lump-sum payments.

Q3: Does the calculator include taxes and insurance?

A: Most payoff calculators focus only on principal and interest. Property taxes and insurance vary and are usually excluded.

Q4: Can this tool help me decide whether to refinance?

A: Absolutely. By comparing scenarios (with and without extra payments), you can see if refinancing makes sense.

Q5: Is the Remaining Mortgage Payoff Calculator free?

A: Yes, most online versions—including ours—are 100% free and easy to use.

Q6: How often should I use this calculator?

A: Ideally, check every few months to track your progress and adjust your strategy.

Q7: Can it show me an amortization schedule?

A: Yes, advanced versions of the tool include a month-by-month breakdown.

Conclusion

Paying off a mortgage is one of the biggest financial goals for most homeowners. But without a clear plan, it can feel overwhelming.

A Remaining Mortgage Payoff Calculator gives you clarity, control, and confidence. By entering a few numbers, you can instantly see how close you are to being debt-free, how much interest you’ll pay, and how to pay off faster.

Whether you want to make extra payments, refinance, or simply track your balance, this tool is your best financial companion.

👉 Try our Remaining Mortgage Payoff Calculator today and take one step closer to financial freedom.

Keywords:

- Remaining Mortgage Payoff Calculator

- Remaining loan balance calculator

- Mortgage payoff date calculator

- How much mortgage left calculator

- Early mortgage payoff calculator

- Mortgage balance payoff calculator

- Payoff mortgage early calculator

- Extra payment mortgage payoff calculator

- Principal only mortgage calculator

- Mortgage payoff interest savings calculator

- Refinance vs mortgage payoff calculator

- Mortgage amortization payoff calculator

- Bi-weekly mortgage payoff calculator

- Remaining mortgage years calculator

- Home loan payoff calculator

- Remaining mortgage balance payoff tool

- Best mortgage payoff calculator 2025

- Remaining mortgage calculator USA

- Calculate remaining mortgage payments

- Payoff mortgage with lump sum calculator

- Mortgage payoff schedule calculator

- Remaining house loan payoff calculator

- Fast mortgage payoff calculator

- 15-year vs 30-year mortgage payoff calculator

- Online mortgage payoff calculator free