Welcome to How to Pay Off Your Mortgage Early Calculator . Becoming debt-free is a dream for millions of homeowners in the United States. A mortgage is usually the largest debt most people will ever take on in their lives. For some, it can feel like an endless journey — 20, 25, or even 30 years of payments. But what if you could pay it off earlier than planned? That’s exactly where a How to Pay Off Your Mortgage Early Calculator comes into play.

This powerful financial tool helps you figure out how much time and money you can save by making extra payments, applying a lump sum, or switching to bi-weekly payments. With the right strategy, you can save tens of thousands of dollars in interest and achieve financial freedom years ahead of schedule.

Table of Contents

In this guide, I’ll walk you through everything you need to know about this calculator — what it is, how it works, why it matters, and how to use it step by step. Along the way, I’ll also answer common questions like “How long until my mortgage is paid off?” and compare different strategies.

What is a “How to Pay Off Your Mortgage Early Calculator”?

A How to Pay Off Your Mortgage Early Calculator is an online tool designed to estimate how quickly you can eliminate your home loan by making additional payments beyond your regular monthly installment.

Unlike a simple mortgage payoff calculator current balance, which only tells you how much you owe right now, this advanced version also factors in:

- Extra monthly payments

- Lump sum contributions

- Bi-weekly payment schedules

- Principal-only payments

By entering your loan balance, interest rate, remaining term, and additional payments, the calculator shows:

- The new payoff date

- Total interest savings

- How many years/months you shave off your mortgage

This makes it a valuable total loan payoff calculator specifically tailored for mortgages.

Why Paying Off Your Mortgage Early Matters

Here’s why so many homeowners search for “how to pay off your mortgage early”:

- Save Thousands in Interest

A 30-year mortgage at 6% interest on a $300,000 home can cost you nearly $350,000 in interest. Paying early could cut that by 40–60%. - Achieve Financial Freedom

Imagine not having a mortgage payment. You free up cash for retirement, investments, or travel. - Reduce Stress

Fewer debts = more peace of mind. - Build Home Equity Faster

With every extra dollar, you’re building ownership in your home more quickly. - Shorten Loan Term

Even a small extra payment each month can take years off your mortgage.

How Does the Calculator Work?

The How to Pay Off Your Mortgage Early Calculator works by recalculating your amortization schedule with your extra payments applied. Here’s how:

Inputs You Provide

- Current loan balance (from your mortgage statement)

- Interest rate (annual percentage)

- Remaining term (years left on your loan)

- Extra monthly payment (optional)

- Lump sum payment (optional)

- Payment frequency (monthly, bi-weekly, etc.)

Outputs You Get

- New payoff date (compared to original)

- Total interest paid

- Interest saved

- Years saved

For example, if your balance is $250,000 at 5% interest with 25 years left, paying an extra $200/month can save you over $40,000 in interest and cut 5 years off your mortgage.

Step-by-Step: Calculate Paying Off Mortgage Early

Here’s how you can use the calculator effectively:

- Enter Your Current Balance

Use the figure from your most recent mortgage statement. This is your starting point. - Add Your Loan Details

Enter your interest rate and remaining term. - Choose a Payment Strategy

- Add a fixed extra monthly payment

- Apply a lump sum (like a bonus, tax refund, or inheritance)

- Switch to bi-weekly payments

- Calculate Results

Hit calculate to see:- New payoff date

- Total savings

- Interest reduced

- Adjust and Compare

Try different scenarios: What if you added $100 extra vs $500 extra? What if you made a one-time $10,000 lump sum?

Lump Sum Payments – A Game Changer

One of the most powerful features of this calculator is the pay off mortgage early calculator lump sum option.

Let’s say you get a $20,000 inheritance. If you apply it directly to your mortgage principal:

- You could cut off 3–5 years of payments.

- Save tens of thousands in interest.

This is why financial experts often recommend putting windfalls into mortgage payoff instead of unnecessary spending.

Bi-Weekly Payments Strategy

Another option built into many calculators is the bi-weekly mortgage payoff calculator. Instead of making one monthly payment, you make half the payment every two weeks.

Why this works:

- 12 months = 26 bi-weekly periods

- That means you’re making the equivalent of 13 monthly payments per year

- One extra payment annually can shave years off your loan

How Long Until My Mortgage is Paid Off?

This is one of the most common questions homeowners ask.

The calculator answers this directly by showing your remaining term based on your chosen strategy. For example:

- Without extra payments: 25 years left

- With $250 extra/month: 19 years left

- With $250 extra/month + $10,000 lump sum: 16 years left

This flexibility makes it far more powerful than a standard mortgage payoff calculator current balance tool.

Total Loan Payoff Calculator vs. Mortgage-Specific Tools

While a total loan payoff calculator can be used for any debt (student loans, car loans, personal loans), a mortgage early payoff calculator with extra payments is specialized. It accounts for:

- Mortgage-specific amortization

- Interest savings from extra payments

- The effect of lump sums on long terms

That’s why it’s better suited for homeowners than generic calculators.

Tips to Pay Off Your Mortgage Faster

- Round Up Payments

If your monthly payment is $1,246, round up to $1,300. - Make One Extra Payment Per Year

Equivalent to bi-weekly strategy. - Apply Windfalls

Use tax refunds, bonuses, or side hustle income as lump sums. - Switch to Bi-Weekly Payments

Sneak in that 13th payment every year. - Consider Refinancing

Moving from a 30-year to a 15-year mortgage can slash interest.

Common Mistakes to Avoid

- Not checking for prepayment penalties

- Using savings for extra payments instead of keeping an emergency fund

- Forgetting to mark payments as “principal only”

- Not comparing refinancing options

Frequently Asked Questions (FAQs) for How to Pay Off Your Mortgage Early Calculator

Q1: What is the fastest way to pay off my mortgage early?

Making consistent extra payments on principal and applying lump sums are the fastest ways.

Q2: How does a mortgage early payoff calculator with extra payments work?

It recalculates your payoff schedule with extra payments included, showing how many years you save.

Q3: Should I pay off my mortgage early or invest?

It depends on your financial goals and interest rate. A calculator helps visualize the benefits of early payoff.

Q4: How long until my mortgage is paid off if I pay an extra $200/month?

Use the calculator with your specific loan details. Typically, $200/month can save 3–6 years.

Q5: Can I make a one-time lump sum payment?

Yes, most lenders allow this. Use the pay off mortgage early calculator lump sum feature to see results.

Q6: Does refinancing help pay off a mortgage early?

Yes, switching to a shorter term like 15 years reduces total interest, though payments may be higher.

Q7: Is bi-weekly payment better than monthly?

Yes, because it adds up to one extra payment per year, cutting years off your loan.

Q8: Do all banks allow principal-only payments?

Most do, but always check with your lender first.

Q9: Can I use a total loan payoff calculator for my mortgage?

Yes, but a mortgage-specific calculator provides more accurate results.

Q10: Is paying off mortgage early always a good idea?

Not always. If your interest rate is very low, investing extra money might yield better returns.

Conclusion for How to Pay Off Your Mortgage Early Calculator

A How to Pay Off Your Mortgage Early Calculator is more than just a tool — it’s a financial roadmap to freedom. By entering your loan balance, interest rate, and extra payments, you can see exactly how much time and money you’ll save. Whether it’s through lump sum contributions, bi-weekly payments, or small monthly increases, the calculator proves that even little steps add up to big results.

If you’re asking yourself “How long until my mortgage is paid off?” — stop guessing. Use the calculator today, explore different strategies, and start your journey toward a debt-free life.

Other Helpful Articles:

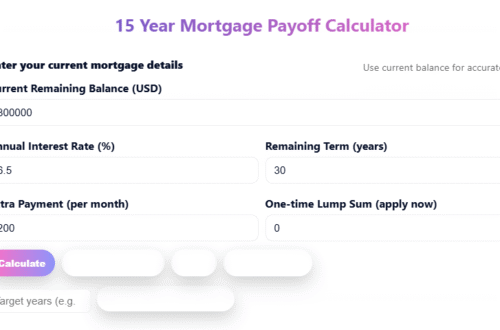

15 Year Mortgage Payoff Calculator: Good to Check Now

Remaining Mortgage Payoff Calculator 2025: Good to Read Now this guide

Early Mortgage Payoff Calculator 2025 : Good to Check Now all details

Keywords:

How to Pay Off Your Mortgage Early Calculator

How to Pay Off Your Mortgage Early Calculator 2025

How to Pay Off Your Mortgage Early Calculator sep 2025

How to Pay Off Your Mortgage Early Calculator september 2025

How to Pay Off Your Mortgage Early Calculator oct 2025

How to Pay Off Your Mortgage Early Calculator throughout the whole year

here is How to Pay Off Your Mortgage Early Calculator