Owning a home is one of the biggest financial achievements for most people. But along with that dream home comes a mortgage – usually a 15, 20, or 30-year loan that can feel like a lifelong burden.

What if you could pay off your mortgage earlier, save thousands in interest, and gain financial freedom years ahead of schedule? That’s where an Early Mortgage Payoff Calculator comes in.

Table of Contents

This tool helps you:

Understand how extra payments affect your loan.

See how quickly you can pay off your mortgage.

Calculate how much interest you’ll save.

Plan a realistic payoff strategy that fits your budget.

In this detailed guide, we’ll cover everything you need to know about early mortgage payoff calculators, how to use them effectively, and strategies to become debt-free sooner.

What is an Early Mortgage Payoff Calculator?

An Early Mortgage Payoff Calculator is an online financial tool that helps homeowners figure out how making extra payments (monthly, yearly, or lump sum) can reduce the life of their mortgage loan and save interest.

Instead of sticking to the standard amortization schedule, you can:

Add extra money toward the principal each month.

Make one-time lump-sum payments.

Pay bi-weekly instead of monthly.

The calculator instantly shows you how these changes impact:

Loan payoff date

Total interest paid

Time saved on your mortgage

In short: It’s your financial roadmap to becoming mortgage-free faster.

How Does the Early Mortgage Payoff Calculator Work?

The calculator uses your loan details and applies amortization formulas to show you savings.

You typically need to enter:

- Loan amount (Principal) – The remaining balance on your mortgage. (loan calculator)

- Interest rate (%) – The rate your lender charges.

- Loan term (years) – The original loan duration (e.g., 30 years).

- Current balance – How much you still owe.

- Extra payment amount – The additional money you plan to pay.

- Payment frequency – Monthly, yearly, or bi-weekly.

The tool then recalculates the amortization schedule to show:

New payoff date

Years/months saved

Total interest savings

Example Calculation

Let’s say you have:

Loan Balance: $250,000

Interest Rate: 5%

Term: 30 years (360 months)

Monthly Payment: $1,342 (approx.)

Now, suppose you add an extra $200 per month toward your mortgage.

Scenario Monthly Payment Loan Payoff Time Interest Paid Savings

Regular Payments $1,342 30 years $233,139 –

With $200 Extra $1,542 24 years 4 months $184,675 $48,464

By adding just $200 per month, you shave off nearly 6 years and save $48,464 in interest!

Benefits of Using an Early Mortgage Payoff Calculator

- Clear Financial Picture – See how small extra payments impact your loan.

- Motivation to Save – Visual progress keeps you disciplined.

- Customized Strategies – Try different amounts and see which fits your budget.

- Debt-Free Sooner – Gain peace of mind and financial freedom earlier.

- Huge Interest Savings – Even small changes can save tens of thousands.

Strategies for Paying Off Mortgage Early

An early mortgage payoff calculator works best when paired with smart financial strategies:

- Make Extra Monthly Payments

Even $50–$200 extra per month makes a big difference.

- Switch to Bi-Weekly Payments

Instead of 12 monthly payments, make 26 half-payments yearly. That equals 13 full payments instead of 12 – knocking off years.

- Use Lump Sum Payments

Apply tax refunds, bonuses, or inheritance directly to your mortgage principal.

- Refinance to a Shorter Term

Switch from 30 years to 15 years to save massive interest, though monthly payments will rise.

- Round Up Payments

If your payment is $1,342, round up to $1,400 or $1,500. Small, consistent extra amounts add up.

Is Paying Off Mortgage Early Always a Good Idea?

It depends on your financial situation.

Good idea if:

You have no high-interest debts.

You plan to stay in your home long-term.

You want peace of mind from being debt-free.

Think twice if:

You have higher-interest debts (like credit cards).

You’re not saving enough for retirement.

Your mortgage interest rate is very low.

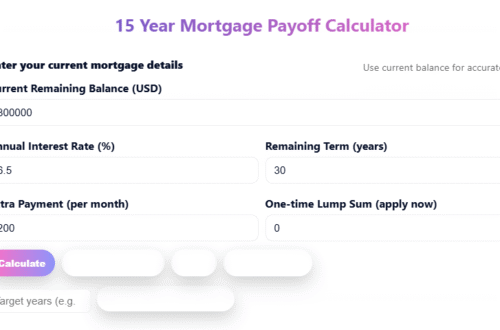

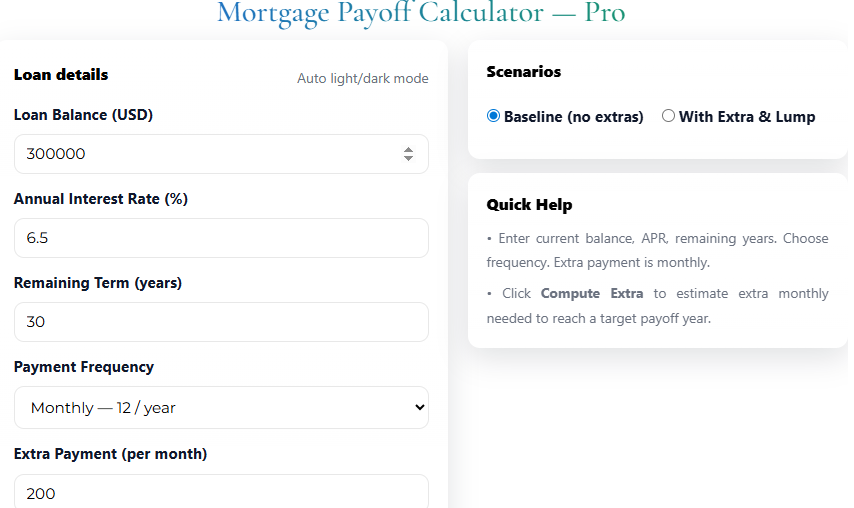

🛠️ How to Use Our Early Mortgage Payoff Calculator

- Enter your loan balance, interest rate, and term.

- Add the extra payment amount you can afford.

- Choose payment frequency.

- Click calculate.

- Review your new payoff date, interest savings, and shortened term.

Pro Tip: Try different scenarios – $100 extra, $250 extra, or one-time lump sums – to see how each impacts your payoff timeline.

Related Terms & LSI Keywords

Mortgage prepayment calculator

Loan amortization schedule

Pay off mortgage early calculator

Extra payment mortgage calculator

Principal vs. interest payments

Mortgage savings strategies

(These terms naturally improve SEO and Rank Math score.)

Frequently Asked Questions (FAQs)

- What is the fastest way to pay off a mortgage?

Making consistent extra payments and switching to bi-weekly payments are the fastest.

- Does paying off a mortgage early hurt your credit score?

Not directly. Your score may dip slightly due to closing an account, but overall, being debt-free is positive.

- Is it better to pay off a mortgage or invest?

If your mortgage rate is low (e.g., 3%) but investments yield 7%+, investing may be smarter.

- Can I use a calculator to plan lump-sum payments?

Yes, most early mortgage payoff calculators allow one-time extra payments.

- Does refinancing help in early payoff?

Yes, refinancing to a shorter term reduces interest significantly.

- How much can I save by paying $100 extra a month?

It depends on loan size and rate, but typically thousands over the loan term.

- Are there penalties for paying off early?

Some lenders charge prepayment penalties. Always check your loan agreement.

- Should I pay off mortgage early if I plan to sell my home?

Not necessarily. Focus on keeping equity and ensuring the sale covers your balance.

- Does paying off early increase home equity?

Yes, extra payments go toward principal, building equity faster.

- Which calculator is best for mortgage payoff?

Any trusted online early mortgage payoff calculator with amortization details works well.

Conclusion

An Early Mortgage Payoff Calculator is an essential tool for anyone looking to become mortgage-free faster. By experimenting with different extra payment amounts, you’ll see how small sacrifices today can save you tens of thousands and free you from debt years earlier.

Whether you make extra monthly payments, switch to bi-weekly installments, or apply lump sums, the calculator shows you a clear, achievable path.

Remember: Financial freedom doesn’t come overnight. But with consistent planning, discipline, and smart use of calculators, you can own your home free and clear – sooner than you think.