If you’ve ever wondered, “How can I pay off my mortgage faster?”, then you’re in the right place. A 15 Year Mortgage Payoff Calculator is one of the most powerful financial tools that can help you clearly see the path to mortgage freedom. Instead of waiting for 25 or 30 years, this calculator helps you figure out how quickly you can be mortgage-free if you choose a 15-year plan, or if you make extra payments.

Mortgages are the biggest debt most Americans carry. According to housing reports, the average homeowner spends decades paying interest. But what if you could save tens of thousands of dollars in interest and own your home much sooner? That’s exactly what a 15 Year Mortgage Payoff Calculator does—it takes your current balance, interest rate, loan term, and any extra payments you can make, and shows you the payoff timeline in detail.

In this article, we’ll dive deep into how the calculator works, why it’s a game-changer, and how you can use it to plan your mortgage payoff strategy.

What is a 15 Year Mortgage Payoff Calculator?

A 15 Year Mortgage Payoff Calculator is an online tool that estimates how long it will take you to pay off your mortgage if you switch to a 15-year repayment plan—or make enough extra payments to finish within that timeline.

Unlike a standard 30-year mortgage payoff tool, this calculator focuses on aggressive repayment schedules. It helps you compare different scenarios, such as:

- How long until my mortgage is paid off if I keep current payments?

- How much faster can I be debt-free with extra payments?

- What if I add a lump sum payment now?

- How much interest can I save by choosing a 15-year payoff strategy?

Essentially, it’s like having a financial roadmap in your pocket.

Why Choose a 15-Year Mortgage Plan?

There are several reasons homeowners prefer a 15-year mortgage over a 30-year term:

- Huge Interest Savings

- With a shorter term, you pay less total interest over the life of the loan.

- Even if your monthly payments are higher, the long-term savings are massive.

- Build Home Equity Faster

- Every payment goes more toward principal than interest.

- This means you build ownership in your property much quicker.

- Financial Freedom

- Imagine being mortgage-free 15 years earlier.

- That gives you more flexibility for retirement, travel, or investments.

- Lower Interest Rates

- Typically, 15-year loans come with lower interest rates compared to 30-year loans.

This is where the mortgage payoff calculator current balance feature becomes crucial—it lets you plug in your existing balance to see if switching to a 15-year payoff plan makes sense.

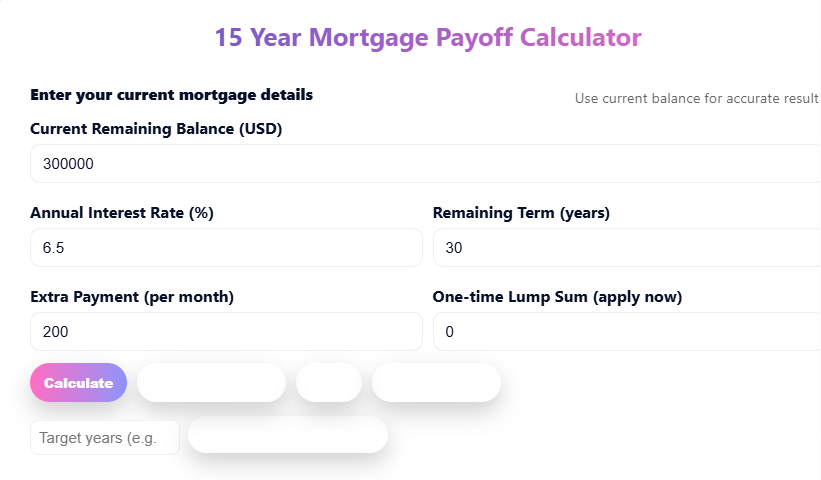

How to Use the 15 Year Mortgage Payoff Calculator

The calculator is simple to use but incredibly powerful. Here’s what you’ll need:

Inputs

- Loan Balance (Current Mortgage Balance) – Enter the remaining amount you owe.

- Interest Rate (APR) – Your loan’s annual percentage rate.

- Remaining Term – How many years are left on your mortgage.

- Extra Payments – Any additional monthly or annual amount you want to add.

- Lump Sum Payments – One-time payments you can apply now or in the future.

Outputs

- Payoff Date – Exact month and year you’ll be debt-free.

- Total Interest Paid – Over the life of the loan.

- Interest Savings – Compared to your current schedule.

- Amortization Schedule – Period-by-period breakdown of payments, principal, and interest.

This is especially useful if you’re trying to calculate paying off mortgage early. With just a few clicks, you can instantly see how extra payments or lump sums impact your loan.

Mortgage Payoff Calculator with Current Balance

One of the best features of a good mortgage calculator is the ability to enter your current balance instead of starting from the original loan.

For example:

- If your original mortgage was $300,000, but after 5 years you owe $250,000, you can enter that current balance.

- The calculator will then adjust and show your payoff timeline starting from today.

This makes it much more accurate for homeowners who are already several years into their mortgage.

How to Calculate Paying Off Mortgage Early

Paying off your mortgage early can sound complicated, but it’s straightforward when you have the right tool.

Step-by-Step Example:

- Current Balance: $250,000

- Interest Rate: 6.5%

- Remaining Term: 25 years

- Extra Payment: $500/month

Result:

- Instead of 25 years, your loan could be paid off in about 17 years.

- Interest savings: over $70,000.

This is why a pay off mortgage early calculator is so valuable—it shows you the power of small extra payments.

How Long Until My Mortgage is Paid Off?

This is one of the most common questions homeowners ask: “How long until my mortgage is paid off?”

The answer depends on:

- Your current balance

- Your interest rate

- Payment frequency

- Extra payments and lump sums

A 15 Year Mortgage Payoff Calculator helps you visualize this timeline. Whether you’re on track for 15 years, 20 years, or 30 years, you’ll know exactly where you stand.

Pay Off Mortgage Early Calculator Lump Sum Strategy

Another popular feature is the lump sum payment option.

Let’s say you receive a $20,000 bonus or inheritance. By applying this amount directly to your mortgage, you could:

- Knock off several years from your loan.

- Save tens of thousands in interest.

The pay off mortgage early calculator lump sum tool allows you to test different one-time payments and see how much faster you can be debt-free.

Total Loan Payoff Calculator vs Specialized Mortgage Calculators

While a total loan payoff calculator can be used for any type of debt (student loans, car loans, etc.), a specialized mortgage payoff calculator is better because:

- It accounts for mortgage-specific details (monthly vs biweekly payments).

- It provides an amortization schedule.

- It compares multiple scenarios side by side.

So while both tools are helpful, for homeowners the mortgage-specific tool is the smarter choice.

Pros and Cons of Paying Off Mortgage Early

✅ Pros

- Save interest money.

- Gain financial freedom faster.

- Build equity quicker.

- Peace of mind—no more monthly payments.

❌ Cons

- Higher monthly commitment (in case of refinancing to 15-year).

- Less flexibility—money tied up in the house.

- Could miss out on potential investment opportunities.

That’s why a calculator is essential—it lets you test your strategy before committing.

Frequently Asked Questions (FAQs)

Q1: What is a 15 Year Mortgage Payoff Calculator?

It’s a financial tool that shows how long it will take to pay off your mortgage within 15 years, with or without extra payments.

Q2: Can I use a mortgage payoff calculator with my current balance?

Yes. Enter your current loan balance, interest rate, and term to get accurate results.

Q3: How do I calculate paying off my mortgage early?

Simply input extra monthly payments or lump sums into the calculator, and it will show you the new payoff date.

Q4: How long until my mortgage is paid off if I make extra payments?

It depends on the size and frequency of extra payments, but a calculator gives you an exact payoff date.

Q5: What is the difference between a pay off mortgage early calculator and a total loan payoff calculator?

The total loan payoff calculator works for any loan type, while a mortgage-specific calculator gives detailed amortization schedules.

Q6: Does making a lump sum payment help?

Absolutely. A single lump sum can reduce years off your loan and save huge amounts of interest.

Q7: Should I pay off my mortgage early or invest the money?

It depends on your financial goals. Paying off early saves interest; investing might give higher returns.

Q8: Can I refinance into a 15-year mortgage?

Yes, many homeowners refinance from a 30-year into a 15-year loan to save money and time.

Q9: Is a 15-year mortgage payoff calculator free to use?

Most online calculators, including ours, are completely free.

Q10: How accurate are mortgage payoff calculators?

They provide close estimates, but actual results may vary depending on lender policies, taxes, and escrow.

Conclusion

The 15 Year Mortgage Payoff Calculator is more than just numbers—it’s a strategy tool for financial freedom. Whether you’re entering your current balance, testing extra payments, or trying a lump sum payoff strategy, this calculator gives you the clarity you need.

If you’ve ever asked, “How long until my mortgage is paid off?”, now you have the answer. By using this tool and adjusting your plan, you can save thousands of dollars and potentially shave years off your loan.

👉 Don’t just make payments blindly—use the 15 Year Mortgage Payoff Calculator today and take control of your financial future.

15 Year Mortgage Payoff Calculator

Keywords:

- 15 year mortgage payoff calculator

- 15 Year Mortgage Payoff Calculator

- 15 year loan payoff calculator

- 15 year mortgage payoff schedule

- 15 year mortgage payoff with extra payments

- 15 year mortgage payoff early calculator

- 15 year mortgage payoff calculator with lump sum

- 15 year fixed mortgage payoff calculator

- now 15 Year Mortgage Payoff Calculator

- 15 year vs 30 year mortgage payoff calculator

- best 15 year mortgage payoff calculator

- free 15 year mortgage payoff calculator online

- mortgage payoff calculator current balance

- calculate paying off mortgage early 15 year

- how long until my 15 year mortgage is paid off

- total loan payoff calculator for 15 year mortgage

- mortgage early payoff calculator 15 year